China Promises Stable Economic Policies

- Share via

BEIJING — Chinese leaders closed a key economic meeting Sunday with pledges to maintain stable fiscal and monetary policies in 2005 and keep a tight lid on so-called fixed-asset investment.

Worried that its economic boom could turn to bust, China has adopted a slew of cooling measures since last year, including curbing investment in fixed assets such as factories and property and raising interest rates for the first time in nine years.

“We will implement stable monetary and fiscal policies and continue to contain excessively rapid growth in fixed-asset investment,” state radio said, citing an announcement after the closing of the annual Central Economic Work Conference. “The macroeconomic controls are timely and effective.”

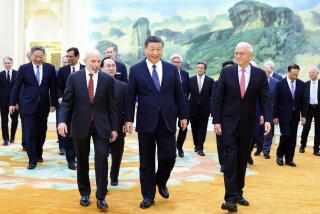

The closed-door meeting, presided over by President Hu Jintao and Premier Wen Jiabao, had been a subject of intense market interest in recent weeks amid speculation that it could yield steps to revalue the yuan currency. But the radio report contained no statements on the yuan, and the policy statements that emerged were in line with earlier state media reports and economists’ expectations.

State radio said China would “strengthen and improve” its tightening measures next year and “pay more attention to the use of market and legal measures” in guiding the economy, the world’s seventh-biggest.

The government would set “reasonable” growth targets for 2005 and keep basic price stability.

China’s economic growth has slowed for several quarters in a row but was still a robust 9.1% in the year through the third quarter.

“The policies will help achieve a soft landing of the economy, and there may be another rate rise,” said Zhao Xijun, economist at the People’s University in Beijing. “But the policies are open to adjustments in the second half if economic growth slows sharply.”

Most analysts had said the meeting was unlikely to yield immediate moves to tinker with the yuan, which has managed to stay in a razor-thin range near 8.28 to the dollar since the Asian financial crisis of the late 1990s.

Beijing has been under pressure from overseas policymakers to allow its tightly held currency to trade more freely. The U.S. and other governments contend that the yuan is undervalued, giving Chinese exporters an unfair advantage in world markets.

Beijing has pledged to make the yuan more flexible through gradual reforms but has rejected calls for a one-shot revaluation.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.