Photos: Keeping score: Investors’ guide to markets in 2015

Stocks of many large, high-quality U.S. companies have been relative refuges amid the recent market tumult. The average large-company stock mutual fund fell about 7.5% in the third quarter, compared with about 10.9% for funds that own small-company stocks. (Mark Lennihan / Associated Press)

Amid wild swings in financial markets this year, here’s a look at how investors are making or losing money in key stock, bond and commodity mutual fund sectors.

These funds own a mix of stocks and bonds based on specific target retirement dates for the investors. The bond portions have helped offset stock losses this year. The result: Year to date most of the funds are down between 3% and 6%, fairly modest declines. (Ulrich Baumgarten / Getty Images)

Emerging markets have suffered some of the heaviest stock losses this year amid severe economic woes in Russia and Brazil and a steep decline in China’s economic growth. The average emerging-market fund is down more than 14% year to date, according to Morningstar Inc. (Paula Bronstein / Getty Images)

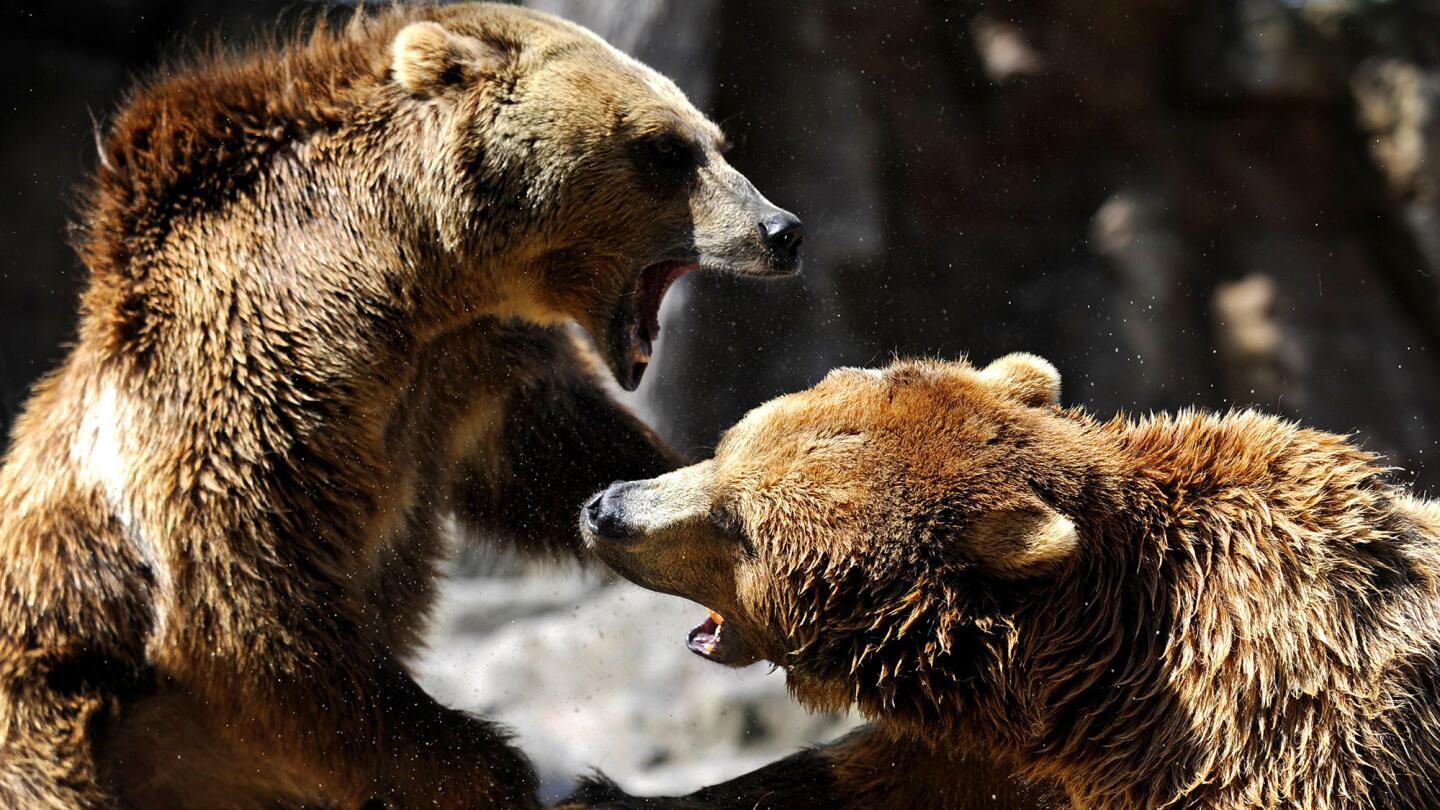

These funds are designed to gain when stock prices are falling. So far this year the average bear-market fund is up about 5%. But the funds have lost an average of 20% a year over the last five years as the bull market has rolled on. (Dani Pozo / AFP/Getty Images)

Advertisement

Muni bonds have been winners this year as some investors have turned to the tax-free securities as a refuge. The bonds often are issued by states, cities and other government units to pay for public works, and their risk of default has historically been low. Funds that own long-term California muni bonds are up about 1.7% this year. (Wally Skalij / Los Angeles Times)

Funds that invest in technology shares lost about 7.7% in the third quarter, but year-to-date the average tech fund is off just 4.1%, while the average blue-chip stock is down 5.2%. Many investors continue to view tech companies as strong long-term growth bets. (Justin Sullivan / Getty Images)

Funds that bet on commodities such as grains, metals and oil were slammed in the third quarter as raw materials prices sank worldwide. The average commodity mutual fund fell about 14% in the quarter, adding to steep losses over the last five years. (Brian van der Brug / Los Angeles Times)

Mutual funds that own shares of real estate investment trusts mostly rose in the third quarter, gaining an average 1.4%, according to Morningstar. The commercial real estate market continues to show strength in many U.S. cities. (Wally Skalij / Los Angeles Times)

Advertisement

European stock mutual funds lost an average of about 7% in the third quarter as global growth fears shook investors. But the average fund is off less than 1% year-to-date. In part the stocks have been helped as the euro currency’s weakness against the dollar has boosted optimism about European exporters. (Chesnot / Getty Images)

Thanks to a massive rally early in the year, Japanese stock funds owned by U.S. investors are up about 3.6% year-to-date, despite a third-quarter swoon. The Japanese government continues to pull out all the stops to try to keep the economy expanding, and the yen’s weakness against the dollar also is helping. (UIG / Getty Images)

Smaller U.S. stocks bore the brunt of the selling in the third quarter, driving the average U.S. small-company mutual fund down about 10.9%, according to Morningstar. Year-to-date the funds are off about 7.7%. Investors tend to view smaller companies, many of which trade on Nasdaq, as riskier in times of economic turmoil. (Noam Galai / Getty Images)

Mutual funds that own Treasury securities were mostly winners in the third quarter as global market jitters drove investors into government bonds, pushing yields down. The average long-term government bond fund rose 4.3% in the quarter. But a big unknown is whether longer-term interest rates will rise once the Federal Reserve begins raising short-term rates. Rising rates would depress the value of older bonds.

(Chip Somodevilla / Getty Images)